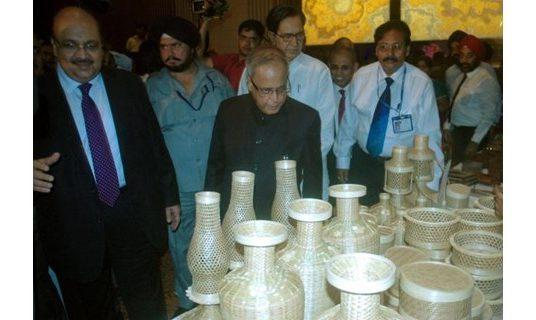

In his address at the 106th Foundation Day Celebrations of the Bank of India, Finance Minister Pranab Mukherjee said that it is part of the government’s priority to promote inclusive growth. Mukherjee highlighted the efforts of public sector banks to expand financial inclusion through the relevant technology. Mukherjee also recommended that banks support entrepreneurs in rural areas through lending.

Banks need to keep strict vigil on asset quality

Exhorting banks to take bold initiatives while maintaining a strict watch on their asset quality in these turbulent times of economic uncertainty and high inflation, Finance Minister Pranab Mukherjee on Wednesday reiterated the Centre’s commitment to inclusive growth and reminded lending agencies of their role in bringing about financial inclusion.

In his address at the 106th Foundation Day celebrations of Bank of India here, Mr. Mukherjee pointed out that living in a globalised world had its benefits but also posed challenges and one such challenge was the global financial crisis.

The inflation challenge faced by India, he said, was partly an offshoot of the policy response in developed countries to global meltdown. “The commitment to moderate levels of inflation has led to higher interest rates. In this environment, banks need to keep a strong vigil on their asset quality,” he said.

PSBs role

Mr. Mukherjee, however, stressed that keeping a strong vigil did not mean keeping away from bold measures. “The global economy is still trying to cope with the after-effects of the financial crisis … These are turbulent times and we should watch every step that we take. But this should not prevent us from taking bold and innovative steps,” he said.

Stressing the government’s firm belief that financial inclusion is a necessary condition for inclusive growth, Mr. Mukherjee pointed to the important role that public sector banks (PSBs) have to play in this regard “given the distribution platform they enjoy and experience they have in serving the rural hinterland for the past five decades”.

Mr. Mukherjee said that technology should be leveraged to scale up the financial inclusion initiative.

“Financial inclusion would make better business sense if banks make that extra effort in developing appropriate business models,” he said while pointing out rural banking as a business opportunity that was waiting to be tapped and which “should not be seen only as a social responsibility to be met by the banks”.

Apart from the aspect of financial inclusion, the Finance Minister noted that banks should help nurture entrepreneurial talent in rural areas through lending and other necessary assistance. In this regard, he maintained that banks could play a very effective role by way of funding the SME (small & medium enterprise) segment.

“When I talk of entrepreneurial talent, the SME segment comes to my mind which has a very high potential for income and employment generation in the country,” he said.

http://www.thehindu.com/business/Economy/article2433058.ece?homepage=true