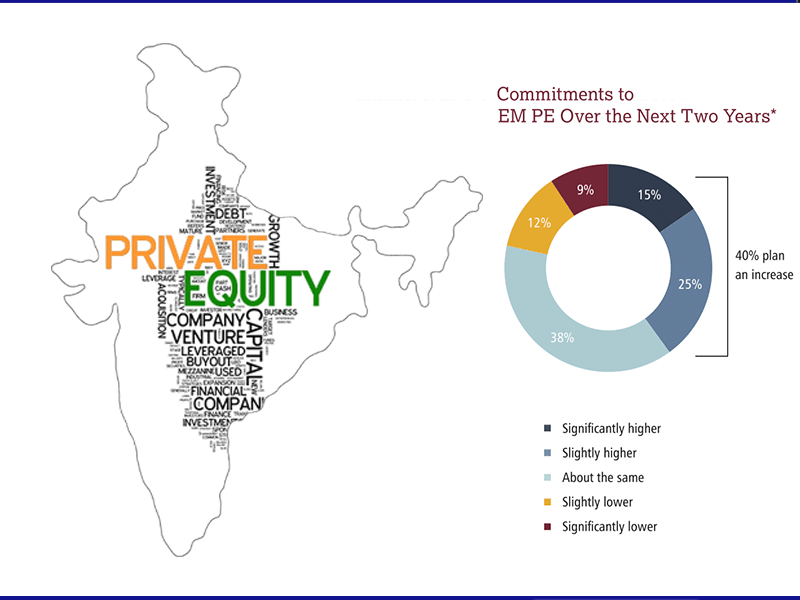

The survey conducted by EMPEA, a global industry association for private capital, featured the views of 107 Limited Partners (LP’s) on emerging markets private equity asset class.

The report said, “India has ridden an impressive wave of upward momentum over the past three years, experiencing the largest positive shifts in the LP attractiveness rankings in both 2015 and 2016.”

“Increasingly bullish LP sentiment toward India coincides with rising fund commitments: in 2015, fund managers raised US$4.5 billion for India—the most raised for the market since 2008.”

The survey showed that 30% of respondents plan to either begin or expand investment in India over the next two years, rather than other emerging markets.

Red Ribbon Asset Management Plc provides a managed route into India for investors who seek responsible wealth generation through the principles of Impact Investment. They are investing in excess of £400 million over the next decade in greenfield projects that are scalable and topical to the Indian economy. Get in touch with them to find out more.

File Name: Investors’ Views of Private Equity in Emerging Markets