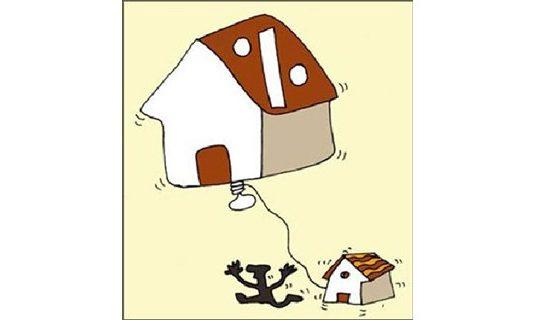

Given the recent negative attention being paid to the Indian microfinance sector, other base-of-the-pyramid lending models are attracting more attention. Micro-housing, providing small loans to help borrowers specifically buy or make improvements to their homes is growing in popularity. Unlike microfinance, the loan sizes are significantly larger “Swarna Pragati Housing Microfinance Ltd, backed by US hedge funds, started operation a month before [and] plans to offer home loans for houses priced below Rs 5 lakh ($11,000).” These funds are not distributed to individual borrowers but to well-established self-help groups who have already formed the kind of social bonds required to ensure that distributed loans are paid back.

After micro finance, micro housing is becoming a buzz word. The sector is not only attracting domestic companies, but also luring foreign financial service firms and institutional players.

Swarna Pragati Housing Microfinance Ltd, backed by US hedge funds, started operation a month before. It plans to offer home loans for houses priced below Rs 5 lakh.

This housing finance company (HFC), subsidiary of US-hedge fund owned Pragati Zwarin Ltd, will initially focus on the Vidarbha region in Maharashtra. It plans to disburse Rs 10 crore (Rs 100 million) of loans in the first year of operation and would venture out to other states after two years, based on experience in business.

“In rural areas, every person has a shelter, which could be inadequate and substandard. What they seek is upgradation in dwelling. Incomes are not predictable beyond three-four years in rural areas.

Borrowers and lenders, especially banks, are not ready to take the liability for a long term, say 10-year, loan,” said A Rameshkumar, chief executive of Swarna Pragati.

Multiple Stakeholders

As a strategy, it does not directly give home loan to a borrower. Instead, it gives credit to mature self help groups (SHGs), as their payment history and behaviour is known.

“These SHGs, in turn, lend to members – incremental loans with average ticket size of Rs 40,000, with three-four years repayment period,” he added.

Similarly, International Finance Corporation (IFC), the National Housing Bank (NHB) and the Rajasthan government are coming together to establish a housing finance company to provide home loans to low-income households in the state.

IFC’s own stake and mobilisation through stakeholders such as NHB, government of Rajasthan, and another private sector player will help establish the company with an initial capital of $22 million (Rs 100 crore). The exact shareholding structure is under discussion. “We are in talks with an established housing finance company, which will take substantial stake in the company to start operation,” said NHB Chairman R V Verma.

“Involvement of multiple stakeholders and the ability to build successful public-private partnerships is crucial to developing an ecosystem that will improve accessibility of housing finance and affordable housing. We will support the company through equity, training, and refinancing,” he added.

According to National Urban Housing and Habitat Policy estimates, of the total shortage of about 25 million affordable housing units in India, 98 per cent constitutes demand from economically stressed and low-income households.

“This is a first-of-its-kind model to harness market opportunities while making affordable housing loans available. If found successful, we will try to replicate in other states,” Verma said.

NBFC Entry

Recently, non-banking finance companies (NBFCs) have shown interest in entering the affordable housing sector, which till recently, was not considered a feasible business proposition.

NBFCs like Muthoot Fincorp, Mahindra and Mahindra Financial Services Ltd and even an established housing finance player such as Dewan Housing Finance Corp are extending small-ticket loans to home buyers.

“Commercial banks find it difficult to extend loans to these borrowers where the income is not documented. These firms, which offer loans of Rs 2-6 lakh to borrowers with a monthly income of Rs 6,000-12,000, aim to cash in on the emerging middle class in rural and semi-urban areas,” said an analyst.

Mahindra Finance provides loans up to Rs 3 lakh through its rural housing finance subsidiary, Mahindra Rural Housing Finance Ltd, for renovating and upgrading existing houses.